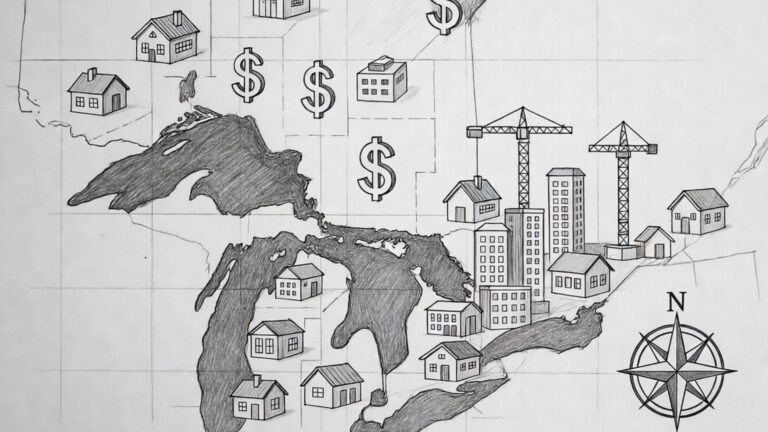

Ontario housing affordability is changing due to rising supply targets, policy reforms, elevated borrowing costs, and record population growth. For buyers and renters, this means more structural reform is underway but real relief will depend on how quickly supply actually reaches the market.

In summary: Ontario housing affordability remains strained, but government housing targets, zoning reforms, and rising rental construction are beginning to reshape the long-term supply outlook. Short-term pressures remain, especially in major urban markets.

Table of Contents

- What’s Driving Ontario Housing Affordability?

- Key Policy Reforms

- Impact on Buyers

- Impact on Renters

- Impact on Investors

- 2026 Outlook

What’s Driving Ontario Housing Affordability?

Several structural forces are influencing Ontario housing affordability:

- Supply Gap: Ontario faces a significant housing shortfall compared to peer nations, with estimates suggesting a deficit exceeding one million homes relative to population needs [1].

- Population Growth: Immigration and interprovincial migration continue to add demand pressure, particularly in the GTA and surrounding growth corridors [2].

- Construction Constraints: Labour shortages, land costs, and infrastructure limitations slow housing delivery [3].

- Higher Borrowing Costs: Elevated interest rates over the past two years reduced purchasing power for many households [4].

Key Policy Reforms Impacting Ontario Housing Affordability

The province has introduced major reforms aimed at accelerating supply:

- More Homes for Everyone Act (Bill 109): Sets municipal approval timelines and fee refund rules to reduce development delays [5].

- Housing Supply Action Plans: Ontario has set an ambitious target of building 1.5 million homes by 2031 [6].

- Rental Construction Growth: Recent ministry data shows rental housing starts reaching multi-decade highs, indicating renewed focus on purpose-built rentals [7].

- Federal Housing Accelerator & National Housing Strategy alignment: Coordination between provincial and federal funding to unlock zoning and infrastructure bottlenecks [8].

Ready to Find Your Dream Home with Bridge ?

Whether you’re a first-time buyer or moving up to your forever home, Bridge guides you through every step — from tailored property searches to expert negotiations — so you can buy with confidence.

What It Means for Buyers

Buyers face a transitional market. Detached homes in prime urban cores remain expensive, while condos, townhomes, and properties in commuter markets present relatively stronger value. Improved inventory levels may enhance negotiation leverage in select regions.

What It Means for Renters

Renters continue to experience affordability strain. While rental construction is rising, vacancy rates remain tight in major cities. Over time, sustained purpose-built rental growth may help stabilize rent increases.

What It Means for Investors

Investors must evaluate regulatory changes, tenant protections, and regional supply pipelines. Markets with improving infrastructure and housing starts may offer stronger long-term positioning as affordability reforms mature.

2026 Outlook for Ontario Housing Affordability

Ontario housing affordability is unlikely to reset overnight. Structural supply increases take years to materialize. However, policy acceleration and sustained construction growth signal a shift toward medium-term stabilization rather than continued rapid escalation.

If you are evaluating buying, selling, or investing decisions, aligning with professionals who understand affordability dynamics and local supply trends is critical in this evolving environment.

FAQs About Ontario Housing Affordability

- Is Ontario housing becoming more affordable?

Affordability remains strained, but policy reforms and increased housing starts aim to improve long-term balance. - What is considered affordable housing in Ontario?

Generally, housing that costs no more than 30% of gross household income. - Will increased supply lower prices quickly?

Supply increases take years to impact pricing materially due to construction timelines. - Are rental starts increasing?

Yes, recent data shows rental construction reaching multi-decade highs.

Sources:

- CMHC – Canada Housing Supply Gap Analysis

- Statistics Canada – Population Estimates

- RBC Economics – Housing Construction Constraints

- Bank of Canada – Interest Rate Policy

- Government of Ontario – More Homes for Everyone Act

- Government of Ontario – Housing Supply Action Plan

- Ontario Ministry of Municipal Affairs & Housing – Annual Report

- National Housing Strategy – Government of Canada