Is now a lucky time to buy in Ontario? In 2026, improving inventory levels, stabilized pricing, and easing borrowing conditions suggest that for many prepared buyers, this may indeed be a lucky time to buy, especially compared to the peak frenzy years of 2021–2022 [1][2].

In summary: 2026 may represent a lucky time to buy for disciplined Ontario buyers because selection has improved, bidding wars have cooled in many regions, and negotiation leverage is stronger than during previous cycles [1]. While not every market is equal, conditions are more balanced than they have been in years.

Table of Contents

- Why 2026 Feels Different

- Inventory Growth & Buyer Leverage

- Are Prices Stabilizing?

- Interest Rates & Affordability

- Who Benefits Most If This Is a Lucky Time to Buy?

- What Risks Still Exist?

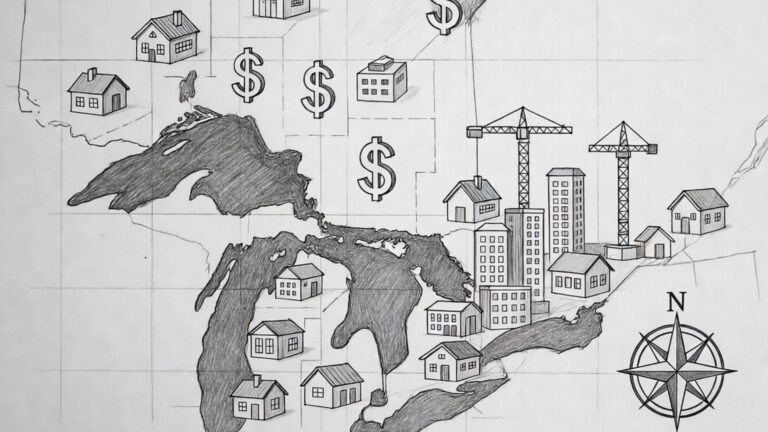

Why 2026 Feels Different

The Ontario market in early 2026 reflects a structural reset. After years of aggressive appreciation and intense bidding competition, higher borrowing costs slowed activity and increased listings across many cities [1].

This transition has created conditions that some analysts describe as a strategic window and can be potentially a lucky time to buy for buyers who were previously priced out.

Inventory Growth & Buyer Leverage

Ontario housing inventory has expanded in several regions compared to pandemic lows [1]. More listings mean:

- Greater property selection

- Fewer unconditional bidding wars

- More room for inspection and financing clauses

- Increased negotiating power

When supply rises faster than demand, pricing pressure softens. For buyers, that shift can feel like a lucky time to buy not because prices are collapsing, but because leverage has improved.

Ready to Find Your Dream Home with Bridge ?

Whether you’re a first-time buyer or moving up to your forever home, Bridge guides you through every step — from tailored property searches to expert negotiations — so you can buy with confidence.

Are Prices Stabilizing?

Recent provincial data shows year-over-year adjustments rather than sharp declines, with many submarkets entering a stabilization phase [2]. This matters because timing the absolute bottom is nearly impossible.

A lucky time to buy is often defined not by the lowest price in history, but by buying during reduced competition while long-term fundamentals remain intact.

Interest Rates & Affordability in 2026

Borrowing costs remain a key factor. After aggressive rate hikes in previous years, central bank policy signals have shifted toward stabilization, with some forecasts suggesting gradual easing if inflation continues moderating [3].

If rates plateau or decline modestly, buyers entering now could benefit from improved refinancing flexibility later and another reason some consider 2026 a lucky time to buy.

Who Benefits Most If This Is a Lucky Time to Buy?

A lucky time to buy in Ontario does not apply universally. It may favor:

- First-time buyers with stable income

- Move-up buyers upgrading without peak pricing pressure

- Investors targeting long-term rental fundamentals

- Relocating families seeking selection over urgency

Strategic buyers who focus on cash flow, neighborhood fundamentals, and long-term holding periods are better positioned than speculative short-term flippers.

What Risks Still Exist?

Even if this appears to be a lucky time to buy, risks remain:

- Economic slowdown scenarios

- Employment volatility

- Unexpected policy shifts

- Regional oversupply in select condo markets

Smart buyers stress-test affordability, avoid overleveraging, and purchase based on lifestyle or long-term investment logic and not short-term headlines.

Conclusion: Is It Truly a Lucky Time to Buy?

For many Ontario buyers in 2026, conditions may indeed represent a lucky time to buy not because of speculation, but because balance has returned to the marketplace. Improved inventory, moderated competition, and policy stabilization have shifted leverage away from extreme seller dominance [1].

If you are evaluating whether this is your lucky time to buy, consider reviewing your financing, local market data, and long-term ownership goals before making a move.

FAQs About Lucky Time to Buy

- Is 2026 really a lucky time to buy in Ontario?

For prepared buyers, improved inventory and moderated competition suggest stronger negotiation power compared to peak years. - Will prices drop further?

Markets are stabilizing in many regions, but predicting exact bottoms is unreliable. - Should I wait for interest rates to fall?

Waiting carries risk. If rates decline, competition may increase again. - Is this a lucky time to buy condos specifically?

Some condo markets show higher inventory, which can provide leverage, but location selection is critical.