Understanding your Ontario home value is crucial for making informed real estate decisions. With fluctuating market conditions and evolving assessment methods, tracking your property’s worth helps maximize investment returns and plan financial futures effectively.

Why Track Your Home’s Value in Ontario?

Regularly monitoring your property’s value provides:

- Financial clarity for refinancing or equity calculations

- Strategic pricing if selling or renting

- Tax assessment accuracy against MPAC evaluations

- Market trend insights to time transactions optimally

Ontario’s housing market shifts rapidly, with values influenced by interest rates, neighborhood developments, and economic factors. Proactive tracking ensures you’re never caught off guard by unexpected changes.

How Property Valuation Works in Ontario

Ontario uses a hybrid system combining municipal assessments and market analysis:

- MPAC Assessments: The Municipal Property Assessment Corporation evaluates properties every 4 years using mass appraisal techniques.

- Sales Comparison Approach: Analyzes recent sales of comparable properties.

- Income/Cost Approaches: Used for rental properties or unique buildings.

While MPAC’s current value assessments form the tax base, market value often diverges due to real-time economic factors.

Key valuation components:

- Location and neighborhood trends

- Property size and usable space

- Age, condition, and renovations

- Local infrastructure developments

Top Tools for Tracking Home Value in Ontario

1. Automated Valuation Models (AVMs)

Platforms like Gnowise use AI algorithms to provide instant estimates using 20+ years of sales data.

2. MLS® Home Price Index (HPI)

REALTORS® use this CREA-developed tool to analyze price trends across 15+ housing categories.

3. Professional Appraisals

Licensed appraisers combine on-site inspections with market analysis for legal-grade valuations.

4. MPAC AboutMyProperty Portal

Access your official assessment and compare it to neighborhood averages.

| Method | Accuracy | Best For |

|---|---|---|

| AVMs | 90-97% | Quick estimates |

| MLS HPI | 98% | Market trend analysis |

| Appraisals | 99% | Legal/financial purposes |

5 Critical Factors Impacting Ontario Home Values

- Interest Rates: Every 1% rate change affects buying power by ~10%

- Regional Developments: New transit lines or schools can boost values by 5-15%

- Housing Supply: Inventory shortages drive competitive bidding

- Energy Efficiency: Green-certified homes sell 2-5% faster

- Assessment Appeals: Successful MPAC challenges can reduce tax burdens by 10-30%

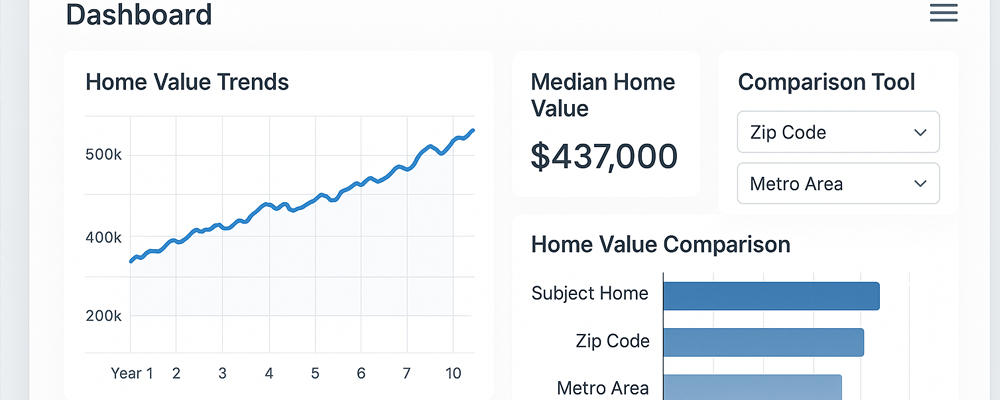

How Bridge Simplifies Value Tracking

Our platform integrates Ontario’s top valuation resources into one dashboard:

- Real-time MPAC comparisons

- Automated market trend alerts

- Renovation ROI calculators

- Appraisal booking portal

When to Re-Evaluate Your Home’s Worth

- Before listing for sale

- After major renovations

- During mortgage renewals

- When neighborhood comps sell

- Post-MPAC assessment cycles

Master Your Property’s Financial Potential

In Ontario’s dynamic market, consistent home value Ontario tracking is no longer optional. By combining automated tools with professional insights, homeowners can protect their investments and capitalize on opportunities.

Ready to take control of your property’s value? Visit Bridge today for personalized tracking solutions and expert guidance.