The best mortgage rates can significantly impact your home buying decisions. Understanding the landscape is crucial for making informed choices.

Understanding Mortgage Rates

Mortgage rates fluctuate based on various factors. These include:

- Economic conditions

- Central bank policies

- Housing market trends

Many buyers focus exclusively on interest rates. However, it’s essential to consider the overall mortgage terms. A slightly higher rate may come with more favorable terms, which could be beneficial in the long run.

Current Market Overview

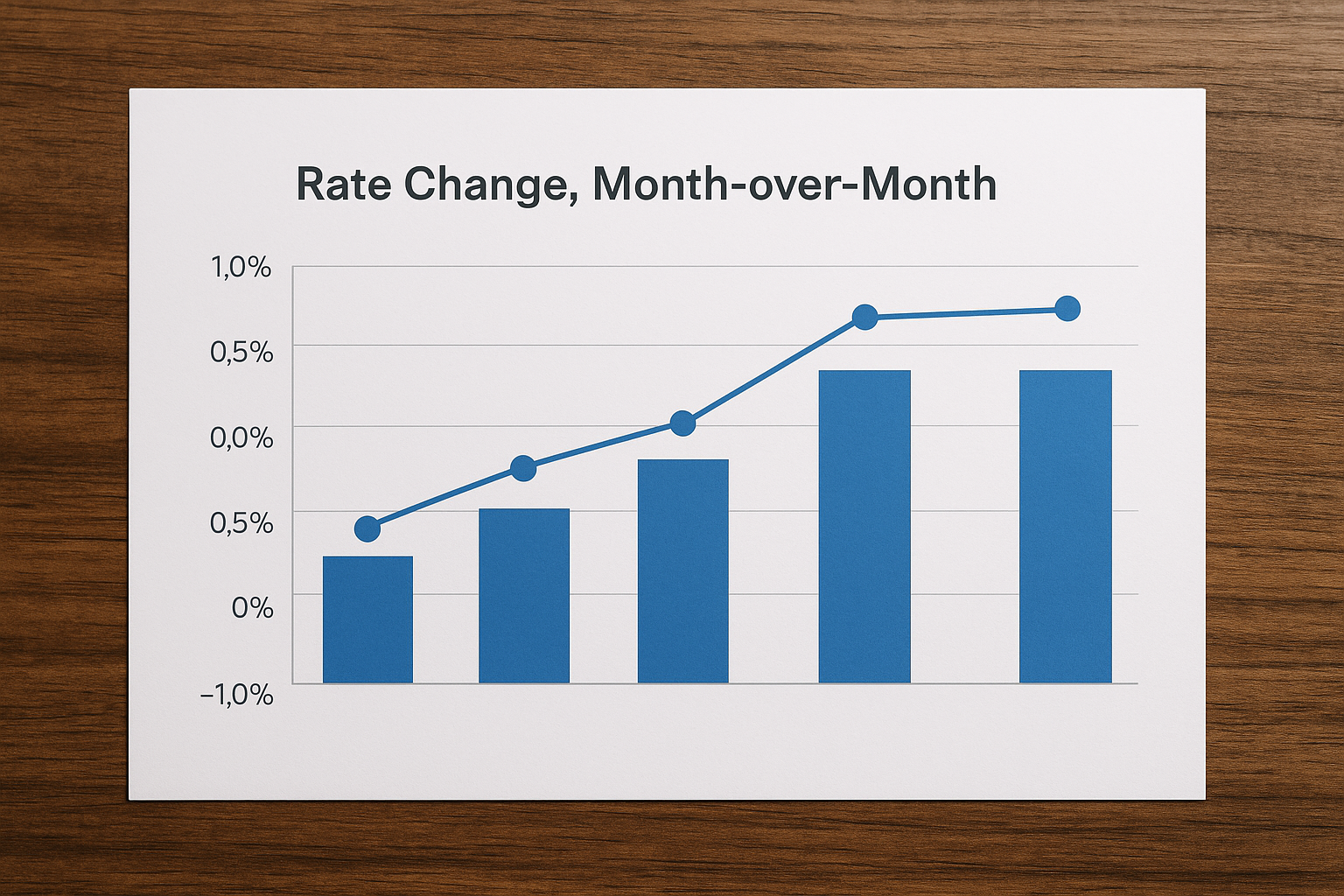

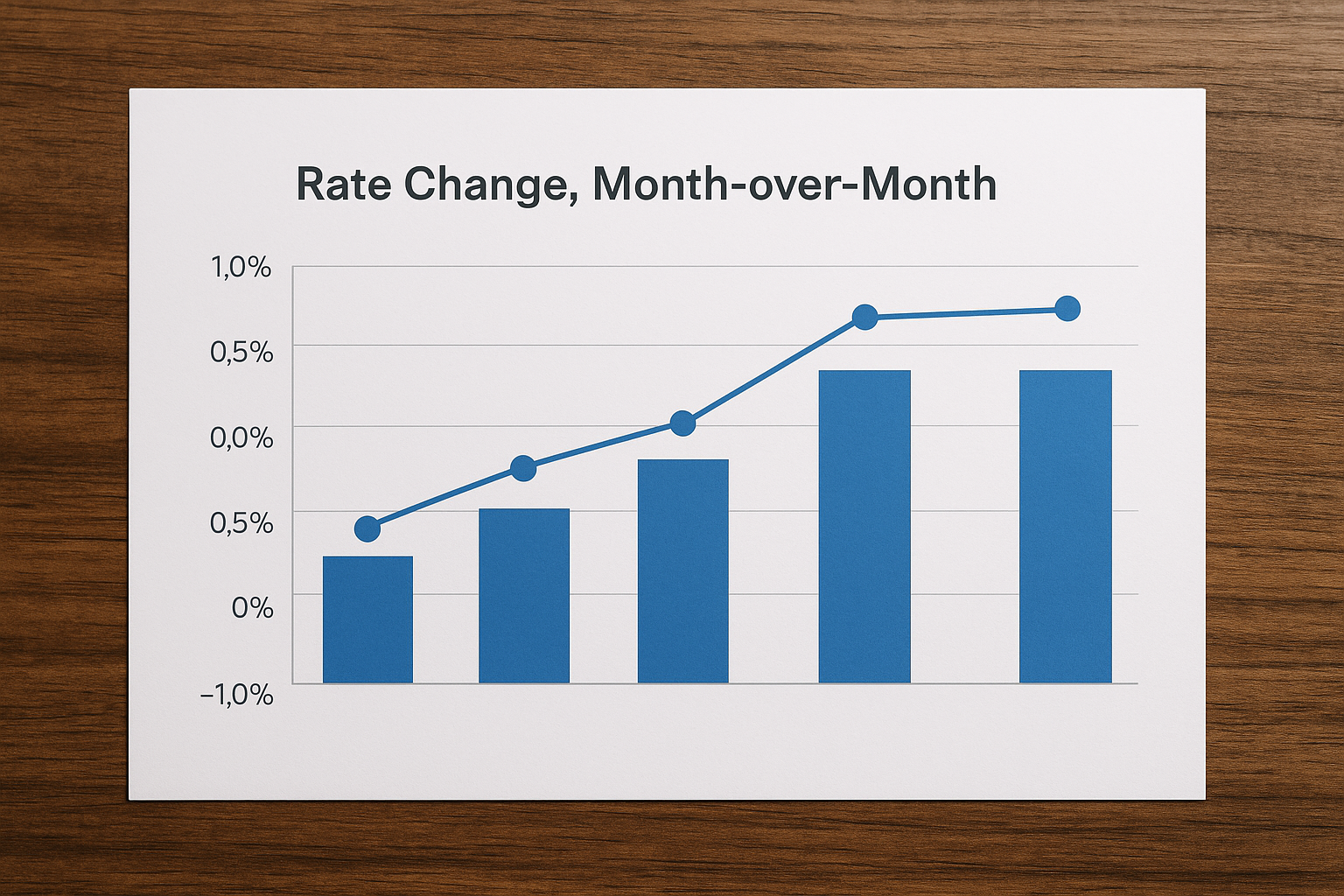

As of June 2025, Ontario is experiencing a dynamic real estate market. Here’s what you need to know:

- Home prices are stabilizing after a period of significant increases.

- Demand for homes remains steady, buoyed by consistent buyer interest.

- New lending regulations are making it easier for first-time buyers to enter the market.

It’s vital to keep an eye on the economic landscape. External factors such as inflation rates and employment statistics can influence mortgage rates.

The Importance of Securing the Best Mortgage Rate

Finding the best mortgage rates is essential for several reasons:

- Lower monthly payments

- Long-term savings

- Improved cash flow for other expenses

A lower mortgage rate can save you thousands over the life of a loan. Just a small percentage difference can have a profound impact on total interest paid.

How to Compare Mortgage Rates

When searching for the best rates, consider these steps:

- Shop around: Check multiple lenders and their offers.

- Understand the terms: Look beyond the rate; consider fees and penalties.

- Consult with a mortgage broker: They can provide valuable insight and access to exclusive rates.

Understand that not all lenders offer the same rates or terms. It pays off to take the time necessary to explore your options.

Fixed-Rate vs. Variable-Rate Mortgages

Deciding between fixed-rate and variable-rate mortgages is crucial. Each option has its advantages.

Fixed-Rate Mortgages

With fixed-rate mortgages, your interest rate remains constant. This stability can be beneficial for budgeting.

- Predictable payments

- Protection against rate hikes

- Ideal for long-term homeowners

Variable-Rate Mortgages

Variable-rate mortgages can fluctuate with market conditions. While they may start lower, they can rise.

- Potential for lower initial rates

- Can lead to overall savings if rates remain stable

- Risk of increasing payments if rates rise

Evaluate your risk tolerance when making this choice.

Preparing for Application

Before applying for a mortgage, consider your financial situation carefully. Necessary preparations include:

- Check your credit score: A higher score can lead to better rates.

- Gather financial documents: Be ready to provide income proof and other necessary documentation.

- Determine your budget: Know how much you can afford to borrow comfortably.

Being organized will streamline your mortgage application process.

Conclusion

Navigating the financial landscape of buying a home in Ontario can be challenging. By understanding the best mortgage rates, you can make wiser decisions. Stay updated on market trends and prepare diligently before applying.

Looking to buy or sell this season? Contact Bridge today.