What are the best Ontario cities long-term wealth investors should consider in 2026? Cities with strong population growth, infrastructure expansion, diversified employment bases, and stable rental demand tend to outperform over multi-year cycles [1][2]. The best Ontario cities long-term wealth strategies focus on fundamentals — not short-term speculation.

In summary: The best Ontario cities long-term wealth growth opportunities in 2026 are concentrated in regions benefiting from immigration, transit expansion, and economic diversification. Strategic buy-and-hold investors continue targeting high-demand corridors rather than chasing quick appreciation spikes [1].

Table of Contents

- How We Define Long-Term Wealth Cities

- Toronto

- Hamilton

- Ottawa

- Mississauga

- Emerging Secondary Markets

- Investment Strategy for 2026

How We Define the Best Ontario Cities Long-Term Wealth Potential

The best Ontario cities long-term wealth performance share four core fundamentals:

- Population and immigration growth [1]

- Transit and infrastructure investment

- Diverse employment sectors

- Consistent rental demand [2]

These fundamentals compound value over time, creating sustainable appreciation rather than volatile price swings.

Toronto: Economic Anchor of Ontario

Toronto remains central to best Ontario cities long-term wealth discussions due to its global connectivity, financial sector dominance, and sustained immigration inflow [1].

While pricing is higher, long-term resilience and rental depth provide defensive stability for disciplined investors.

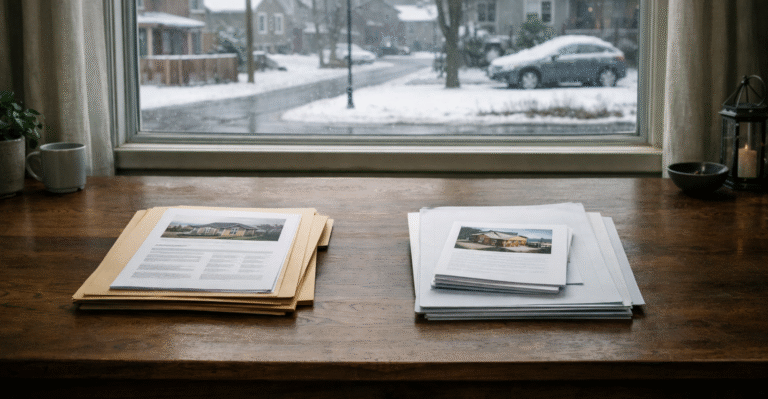

Ready to Find Your Dream Home with Bridge ?

Whether you’re a first-time buyer or moving up to your forever home, Bridge guides you through every step — from tailored property searches to expert negotiations — so you can buy with confidence.

Hamilton: Infrastructure & Relative Value

Hamilton benefits from proximity to the GTA, transit expansion, and comparatively accessible price points. Investors targeting value-driven appreciation continue monitoring this corridor closely.

As infrastructure projects mature, Hamilton may strengthen its case among best Ontario cities long-term wealth seekers.

Ottawa: Government Stability & Tech Growth

Ottawa combines federal government employment stability with expanding technology sectors, creating a diversified economic base. Stable employment supports long-term housing demand [2].

Mississauga: Corporate & Condo Expansion

Mississauga’s continued high-rise development and corporate presence support sustained rental and ownership demand. Transit-oriented development remains a key driver.

Emerging Secondary Markets

Beyond major centers, mid-sized cities across Southwestern and Eastern Ontario are attracting migration due to affordability and lifestyle factors [1].

These markets may offer higher relative yield, though with slightly increased volatility compared to core metropolitan anchors.

Investment Strategy for 2026

Investors targeting the best Ontario cities long-term wealth outcomes in 2026 should focus on:

- Buy-and-hold time horizons (7–10+ years)

- Cash-flow analysis under conservative assumptions

- Transit-accessible neighborhoods

- Diversified tenant demand drivers

Long-term wealth accumulation in Ontario real estate historically rewards patience, disciplined financing, and location selection over short-term timing.

Conclusion

The best Ontario cities long-term wealth opportunities in 2026 are not necessarily the fastest-growing markets this quarter. They are the cities with infrastructure, migration, and economic diversification that compound value steadily over time.

Before investing, evaluate your risk tolerance, capital structure, and holding strategy carefully.

FAQs About Best Ontario Cities Long-Term Wealth

- Which city in Ontario builds the most long-term wealth?

Toronto remains the most resilient anchor market, though strong secondary cities can outperform over specific cycles. - Are smaller Ontario cities better for long-term wealth?

They may offer higher relative yields, but typically carry greater volatility risk. - Is 2026 a good year to invest for long-term growth?

Balanced market conditions and infrastructure expansion support strategic entry for long-term investors. - Should I prioritize cash flow or appreciation?

A sustainable long-term strategy often balances both rather than relying solely on speculative appreciation.