The Ontario rental market is entering a moment of recalibration in 2025. After years of relentless growth in rents and demand, recent trends suggest softness, higher vacancy, and more negotiating power for tenants. For landlords both seasoned and new, this shift has implications for rent-setting, tenant management, and portfolio strategy.

Let’s dig into the numbers, what’s changing, and how landlords can adapt.

Recent Trends & Data

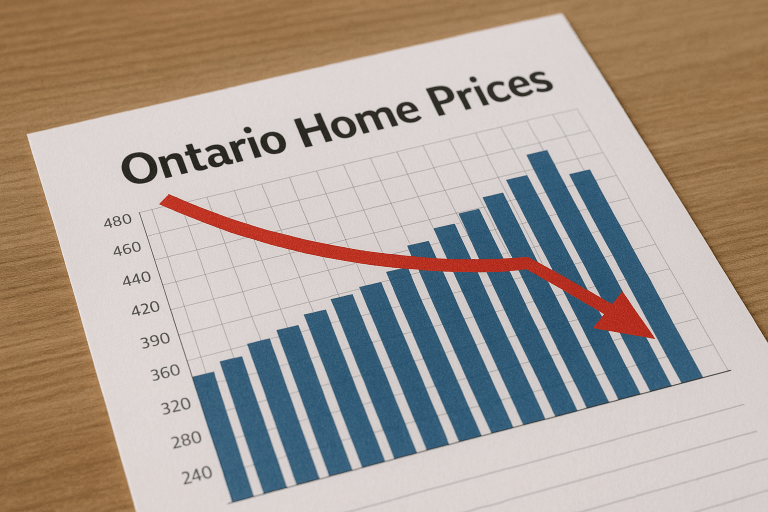

- According to CMHC’s 2025 Mid‑Year Rental Market Update, national vacancy rates are rising, supply is expanding, and rent growth is cooling. [1]

- In the Greater Toronto Area (GTA), TRREB reports condominium apartment rentals leased through MLS jumped 16.6% year-over-year in Q2 2025, while average one-bedroom rents dipped ~5.1%. [2]

- Rentals.ca shows that Canada’s asking rents have declined for nine straight months, reflecting softer demand pressure. [3]

- In Ontario more specifically, average asking rents in July showed units in Markham and Oakville surpassing downtown Toronto levels. [7]

- The rent increase guideline in Ontario (under the Residential Tenancies Act) caps most annual rent hikes at 2.5% in 2025, barring exceptions. [5]

- FRPO (the Federation of Rental-housing Providers of Ontario) has commissioned studies from Urbanation to project rental demand and supply in Ontario to 2034, highlighting potential gaps and pressures in key regions. [6]

Together, these data points tell a clear story: rental growth is still positive in many markets, but pressure is mounting, and landlords will face headwinds this year.

Key Drivers Behind the Shift

1. Increased Rental Supply

Many new condo and rental developments completed in recent years are now entering the rental market, adding competition to existing units.

In the GTA, the surge in rental listings is already pressuring pricing power. [2]

2. Softening Demand

Tailwinds like population growth and immigration are slowing. Some renters are pushing to ownership when mortgage rates become more favorable. [4]

3. Tenant Negotiating Leverage

Longer lease turnovers and more inventory give tenants more bargaining power. Landlords may see more requests for concessions, upgrades, or rent reductions.

4. Regulated Rent Increases

With the cap of 2.5% for 2025 in Ontario, landlords are constrained in how much rent they can increase on existing tenancies. [5]

5. Geographic & Property Type Variation

Not every neighborhood is equally affected. High-end urban condos may feel more pricing pressure than suburban rentals or multi-family units in growth corridors.

What Landlords Should Do Now

- Review new leases carefully: Be ready to offer minor incentives (e.g., one month free, upgrades) to attract quality tenants in a competitive market.

- Focus on retention: Retaining existing tenants yields better ROI than chasing new ones; consider modest improvements and responsive maintenance.

- Reassess rent strategy: Don’t apply across-the-board increases; perform local comparable and adjust per building/neighborhood.

- Audit your cost structure: In a tighter market, efficiencies in maintenance, property taxes, and utilities become more significant.

- Diversify property mix or location: Consider acquiring in less saturated submarkets or purpose-built rentals which may be more resilient.

- Stay informed on regulation: Monitor changes in laws, rent guidelines, and landlord‑tenant rules so you can act proactively.

FAQs in Ontario Rental Market for Landlords

- Will rents decline broadly in 2025?

Not broadly in all markets. Some regions may see flat or slightly negative rent growth if supply outpaces demand, but many will still experience modest growth — especially in strong markets. - Can landlords legally raise rent above 2.5% in 2025?

Yes, but only through approval from the Landlord and Tenant Board, and only in specific situations (e.g. significant capital expenditures). [5] - Should I lower rent to avoid vacancy?

It depends. In highly competitive areas, offering small concessions may help, but don’t undercut market rates too much get comparable first. - Is condo vs purpose-built different now?

Yes. Condo rentals tend to see more volatility in soft markets, while purpose-built (multi-unit) tends to have more stable demand, especially in growth corridors.

Sources:

- CMHC 2025 Mid-Year Rental Market Update Canada Mortgage and Housing Corporation

- TRREB Q2 2025 Rental Market Report TRREB

- Rentals.ca national rent decline report Rentals.ca

- PayProp Canada “New supply, low demand, flat rents” PayProp

- Ontario rent increase guideline (Residential Tenancies Act) Ontario

- FRPO / Urbanation rental market studies in Ontario FRPO

- Ontario Rent Report for Markham & Oakville July 2025 liv.rent