Investing in Ontario real estate can be both rewarding and complex. For 2025, understanding the tax implications of investment properties is critical for effective real estate tax planning. This guide breaks down the latest updates, key tax considerations, and financial planning strategies for Ontario investors.

Understanding Real Estate Tax Planning in Ontario

Real estate tax planning is essential for anyone investing in Ontario’s property market. With changing tax rates, new government incentives, and evolving regulations, investors must stay informed to maximize returns and minimize liabilities. Whether you own rental properties, flip homes, or hold commercial real estate, strategic planning can make a significant difference in your bottom line.

Key Tax Changes for 2025

Several important tax updates will impact Ontario real estate investors in 2025:

Capital Gains Tax: The federal government has cancelled the planned increase to the capital gains inclusion rate for 2025 . Investors will continue to pay tax on 50% of any capital gains realized from the sale of investment properties. For example, if you sell a property and realize a $200,000 gain, only $100,000 is taxable. Your total tax payable will depend on your overall income and tax bracket.Principal Residence Exemption: The sale of your primary home remains tax-free. Only investment or secondary properties are subject to capital gains tax.Lifetime Capital Gains Exemption (LCGE): Effective June 25, 2024, the LCGE increased to $1.25 million for qualifying small business shares and farming or fishing properties. This does not generally apply to typical residential investment properties but is crucial for those with eligible holdings.Canadian Entrepreneurs’ Incentive: Starting in 2025, this incentive reduces the capital gains inclusion rate to one-third for qualifying businesses, up to a lifetime maximum of $2 million. This provides substantial savings for eligible investors.

For more detailed federal updates, see TurboTax Canada and Royal LePage Leading Edge .

Ontario Property Tax Rates and Fees

Ontario property owners should be aware of both municipal and provincial property taxes. In Toronto, for example, 2025 proposed tax rates are:

Residential: 0.592653% (plus a City Building Fund of 0.008434%)Multi-Residential: 1.036734%Commercial: 1.385397%Industrial: 1.483217%

Education tax rates are set by the Government of Ontario and are pending approval . The final tax bill is calculated by multiplying the property’s assessed value by the total applicable tax rate.

Special Property Tax Classes

New Multi-Residential Subclass: Newly constructed multi-residential properties may qualify for a 15% reduction in municipal property taxes for 35 years.Small Business Tax Subclass: Eligible small businesses receive a 15% reduction in the commercial tax rate.

For the latest rates and fees, visit the City of Toronto Property Tax Rates & Fees page.

Income Tax and Rental Properties

Rental income from investment properties is fully taxable and must be reported on your annual tax return. Key considerations for 2025 include:

Income Tax Bracket Adjustments: Federal and Ontario income tax brackets have been adjusted for inflation, potentially lowering your effective tax rate.CPP Contributions: Canada Pension Plan contributions have increased for 2025, affecting your overall tax planning.Deductions: Investors can deduct eligible expenses such as mortgage interest, property taxes, insurance, repairs, and management fees from rental income. Proper documentation is essential for maximizing deductions and minimizing audit risk.

For more on income tax changes, see Real Estate Tax Tips .

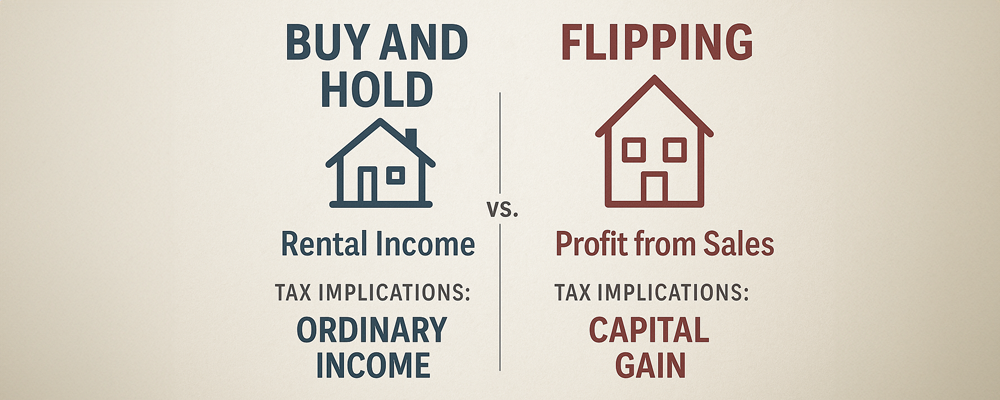

Capital Gains vs. Income: Flipping vs. Holding

How you structure your investment strategy affects your tax obligations:

Buy and Hold: Properties held for rental income and eventual sale are taxed on capital gains, with only 50% of the gain being taxable.Flipping Properties: Properties bought and sold for quick profit are taxed as business income, with 100% of the profit being taxable at higher rates.

Incorporating as a Personal Real Estate Corporation (PREC) can offer tax deferral opportunities for professionals, but may not be suitable for all investors. Learn more about this strategy at Doane Grant Thornton .

Financial Planning Strategies for 2025

To optimize your real estate tax planning in Ontario for 2025:

Track All Expenses: Maintain detailed records of all property-related expenses for maximum deductions.Monitor Policy Changes: Stay updated on federal and provincial tax changes that may affect your investments.Consider Incorporation: Evaluate whether a corporate structure could benefit your tax situation.Consult Professionals: Work with a tax advisor or accountant specializing in real estate to develop a customized tax strategy.

Conclusion: Take Action with Bridge

Effective real estate tax planning is essential for Ontario investors in 2025. By understanding the latest tax rules, leveraging available incentives, and planning ahead, you can protect your investments and grow your wealth.

Ready to optimize your real estate portfolio? Contact Bridge today for expert advice and personalized financial planning.