Ontario real estate financing options are vital to understand for anyone looking to navigate the property market. Choosing the right financing option can make all the difference in your buying or selling experience.

Understanding Ontario Real Estate Financing Options

Financing a home in Ontario doesn’t have to be overwhelming. It’s essential to explore various options available to find the best fit for your needs. In this blog post, we will explore some common financing options, their advantages, and any potential drawbacks.

1. Traditional Mortgages

Traditional mortgages are among the most popular financing options. They usually come from banks and credit unions.

- Fixed-rate mortgage: This is when the interest rate stays the same for the entire duration of the loan. It offers stability.

- Variable-rate mortgage: The interest rate can change based on the market. This option may offer lower initial rates but comes with risks.

Each traditional mortgage type has distinct advantages, such as predictable payments with fixed-rate mortgages. However, variable rates can sometimes lead to fluctuating payments, making budgeting difficult.

2. Alternative Financing Options

If traditional mortgages aren’t a good fit, consider alternative financing options available in Ontario.

a. Home Equity Lines of Credit (HELOC)

A HELOC allows homeowners to borrow against the equity of their home.

- Flexibility: Borrow only what you need and pay interest only on that amount.

- Lower interest rates: Typically lower than personal loans or credit cards.

However, it’s essential to remember that this option puts your home at risk if you cannot make repayments.

b. Private Lenders

Private lenders can offer more flexible qualification criteria and quicker approval processes.

- Fast access to funds: Ideal for those who need funding quickly.

- Customizable terms: Often offers more flexible terms compared to traditional lenders.

Keep in mind that private lenders may charge higher interest rates and fees, which could be a disadvantage.

3. Government Programs

Ontario residents can also benefit from various government programs designed to assist buyers and those looking to finance a home.

a. First-Time Home Buyer Incentive

This program helps first-time buyers by providing up to 10% of the home’s purchase price.

- Reduced monthly payments: The incentive helps lower your mortgage payment.

- Shared equity: The government shares in the property’s future appreciation.

This program does have eligibility criteria, so ensure you check if you qualify.

b. Ontario Home Ownership Savings Plan

This saving plan allows you to save for a down payment on your home.

- Tax benefits: Contributions may offer tax deductions.

- Encourages saving: Set aside money specifically for your future home.

Understanding these government programs can enable you to take advantage of additional resources available to you.

4. Considerations When Choosing Financing Options

Selecting the right financing option is a significant decision. Here are some critical factors to consider:

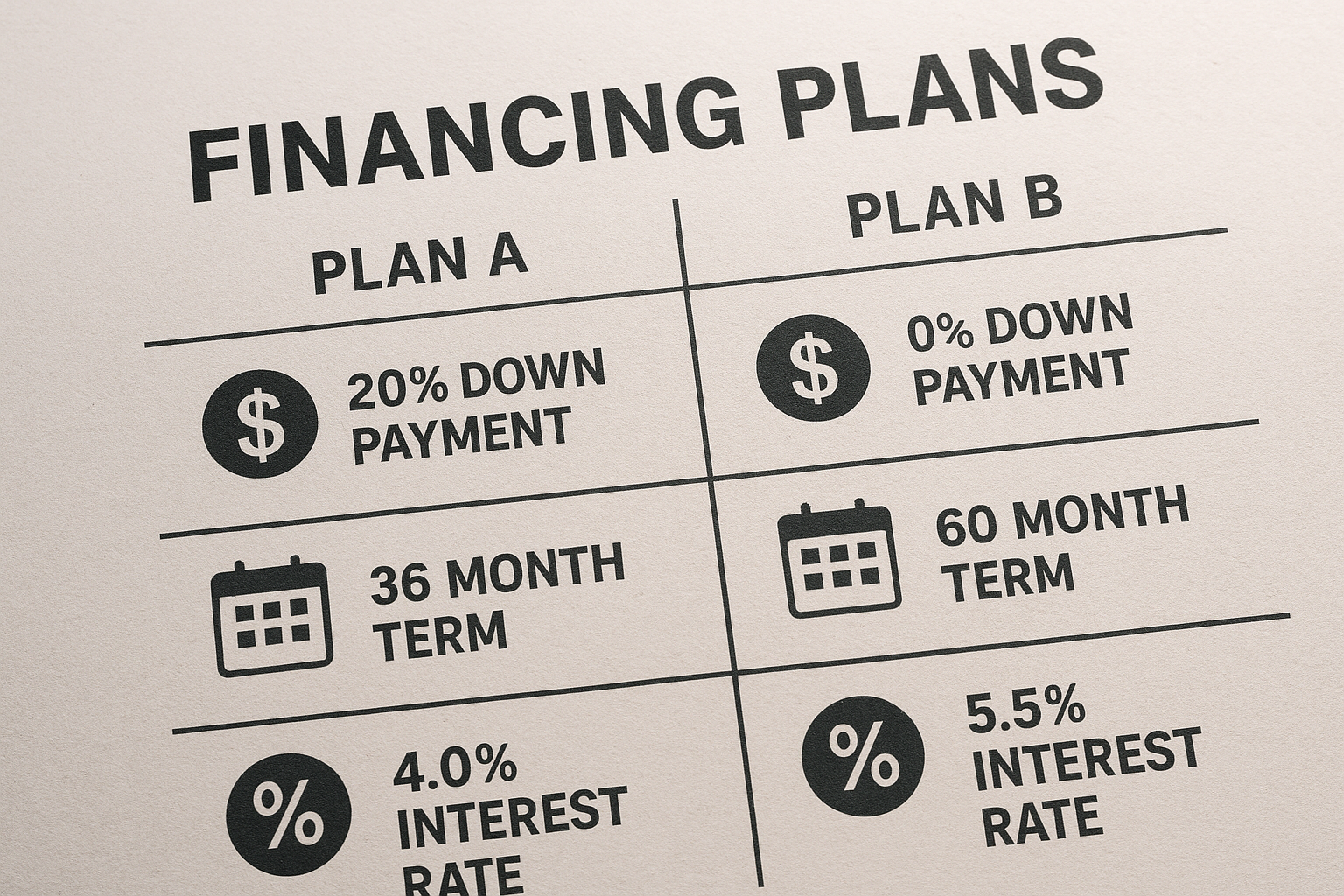

- Interest rates: Compare rates from various lenders to get the best deal.

- Loan terms: Look into the loan period and monthly payments.

- Your financial situation: Assess your credit score and current debts.

- Future plans: Consider how long you plan to stay in the home.

Taking the time to evaluate each option can lead to a more informed and beneficial choice.

Conclusion

Understanding Ontario real estate financing options can set you on the right path towards homeownership or a successful property sale. Utilize traditional mortgages, alternative financing, or government programs according to your needs.

By considering all the available options, you can make well-informed decisions that will benefit you in the long run.

Looking to buy or sell this season? Contact Bridge today.