Mortgage myths can cloud your understanding of home financing.

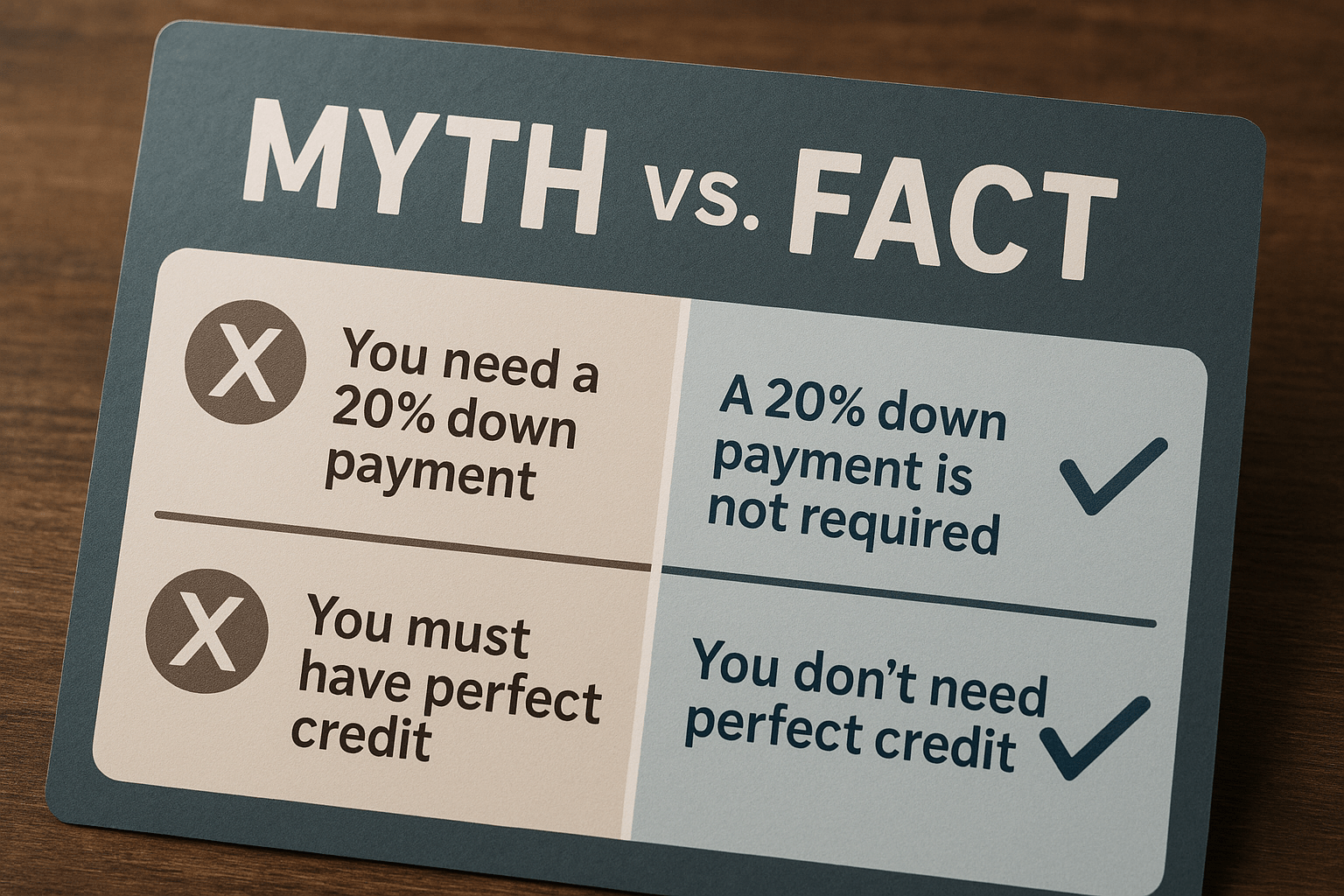

Understanding Common Mortgage Myths

Many first-time buyers and even seasoned homeowners fall victim to misconceptions about mortgages. These inaccuracies can lead to confusion and costly mistakes. It’s vital to separate fact from fiction.

Myth 1: You Need a 20% Down Payment

Many believe that a 20% down payment is a requirement for purchasing a home. This is not true.

- Many lenders offer programs with as little as 5% or even 0% down.

- First-time homebuyer assistance programs may also be available.

Understanding your options can make homeownership more accessible.

Myth 2: Your Credit Score Must Be Perfect

Another common misconception is that only those with a perfect credit score can qualify for a mortgage.

- While a higher score can lead to better rates, many lenders work with borrowers who have scores in the 600s.

- Improving your credit score is possible with time and effort.

Don’t let a less-than-perfect score deter you from pursuing your dream home.

Myth 3: All Lenders Have the Same Rates

Many buyers assume that all lenders offer similar rates. In reality, rates can vary significantly based on various factors.

- Lender fees can differ.

- Your personal financial situation plays a crucial role.

- Shopping around can save you thousands over the life of the loan.

Always compare various lenders before settling on a mortgage.

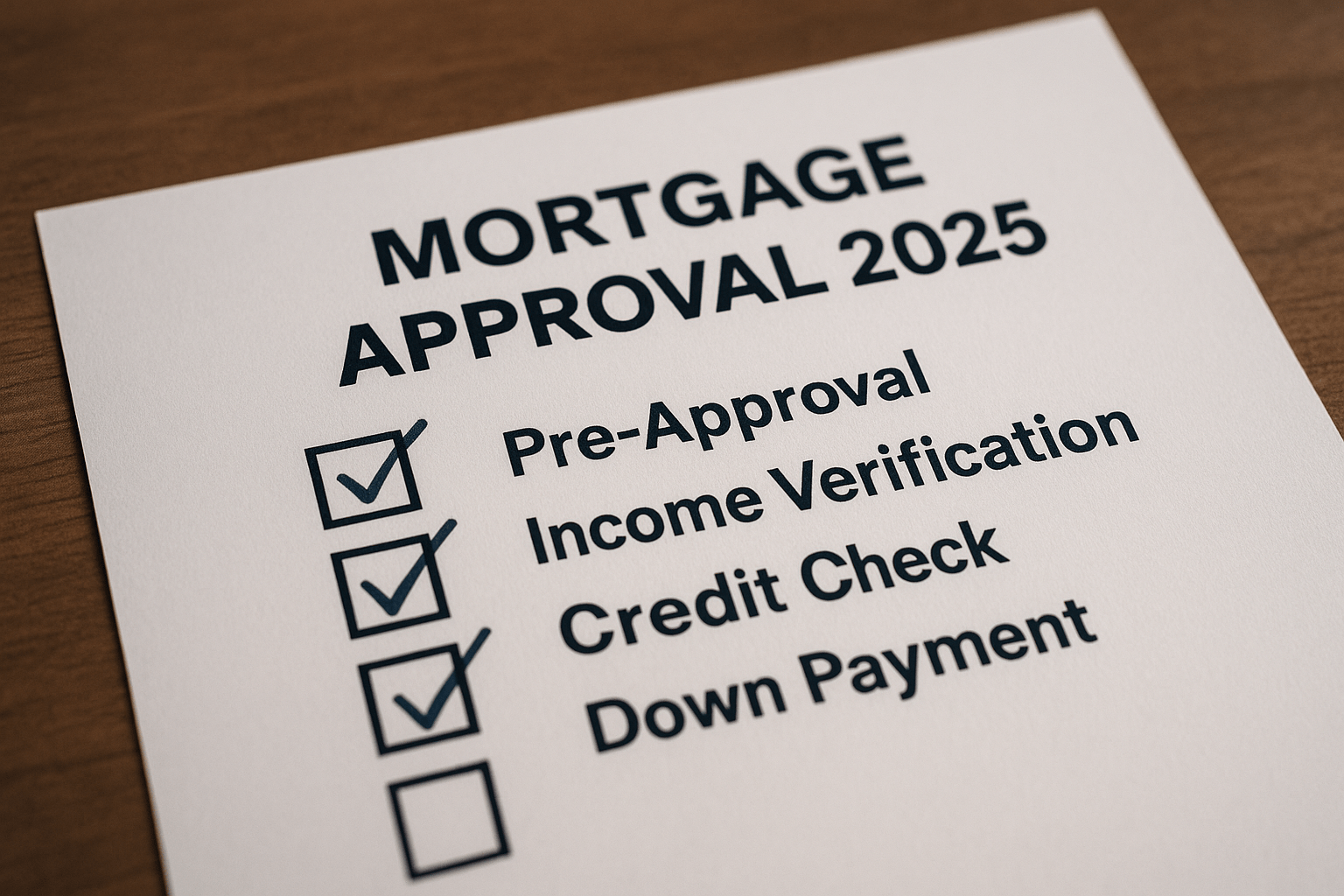

Myth 4: Pre-qualification is the Same as Pre-approval

These terms are often used interchangeably, but they are not the same.

- Pre-qualification is a preliminary step that gives you an idea of how much you can borrow.

- Pre-approval is a more in-depth process that provides a conditional commitment for a specific loan amount.

Getting pre-approved gives you a stronger position when making an offer.

More Myths Debunked

Let’s look at additional common mortgage myths that may impact your buying or selling decisions.

Myth 5: You Can’t Get a Mortgage if You’re Self-employed

Self-employment can complicate the mortgage process, but it doesn’t make it impossible.

- Lenders will review your income, business stability, and credit history.

- Being organized with your financial documents can help your case significantly.

Self-employed individuals should work closely with knowledgeable lenders.

Myth 6: You Don’t Need a Home Inspection

Some buyers may think that if a home looks good, they don’t need an inspection.

- A home inspection helps uncover hidden issues that could be costly to fix.

- Skipping this step may lead to regrettable surprises down the line.

Investing in a home inspection can save you money and heartache.

Myth 7: You Can’t Cancel a Mortgage

Many believe once you commit to a mortgage, you cannot change it or walk away.

- Most mortgages have a specified period for cancellation.

- Refinancing is also an option if interest rates drop.

Understanding your mortgage terms gives you more flexibility than you think.

Conclusion

Navigating the mortgage landscape can be overwhelming, especially with so many mortgage myths floating around. Knowledge is your best ally in making informed decisions.

Always do your research, ask questions, and consult with experts when needed.

Looking to buy or sell this season? Contact Bridge today.