Getting a mortgage can feel daunting. But having a proper mortgage approval checklist can simplify the process.

Understanding the Mortgage Approval Process

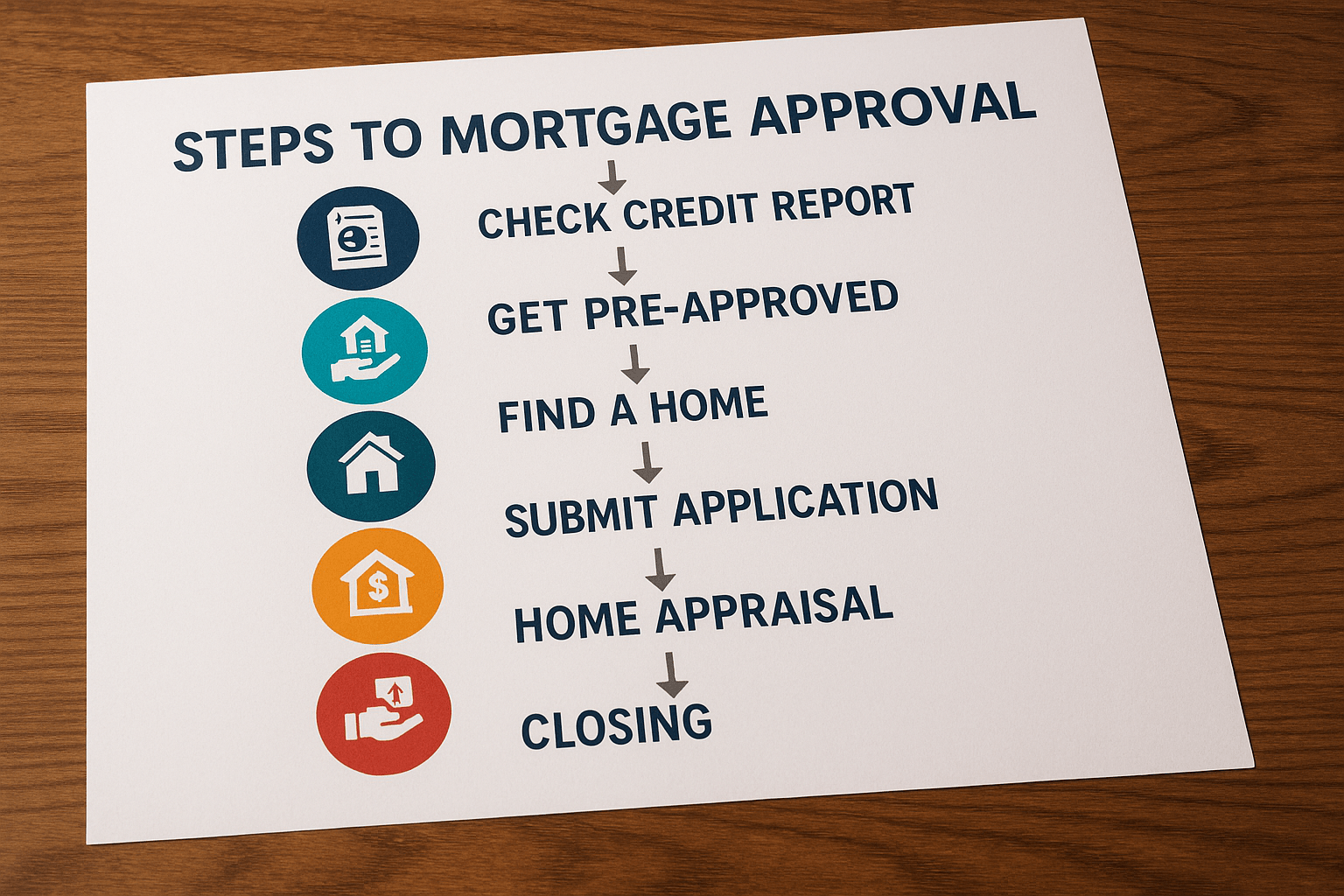

Before you begin, it’s essential to know what lenders look for. The mortgage approval process involves several key steps. Understanding these steps will help you navigate your application smoothly.

Key Factors Lenders Consider

Lenders assess several factors to determine your eligibility. These include:

- Credit Score – A critical factor that influences interest rates and approval.

- Debt-to-Income Ratio – Measures your monthly debt against your income.

- Employment History – Lenders prefer stable employment over the last few years.

- Down Payment – A larger down payment may improve your chances.

- Property Appraisal – Lenders need to ensure the property is worth the loan amount.

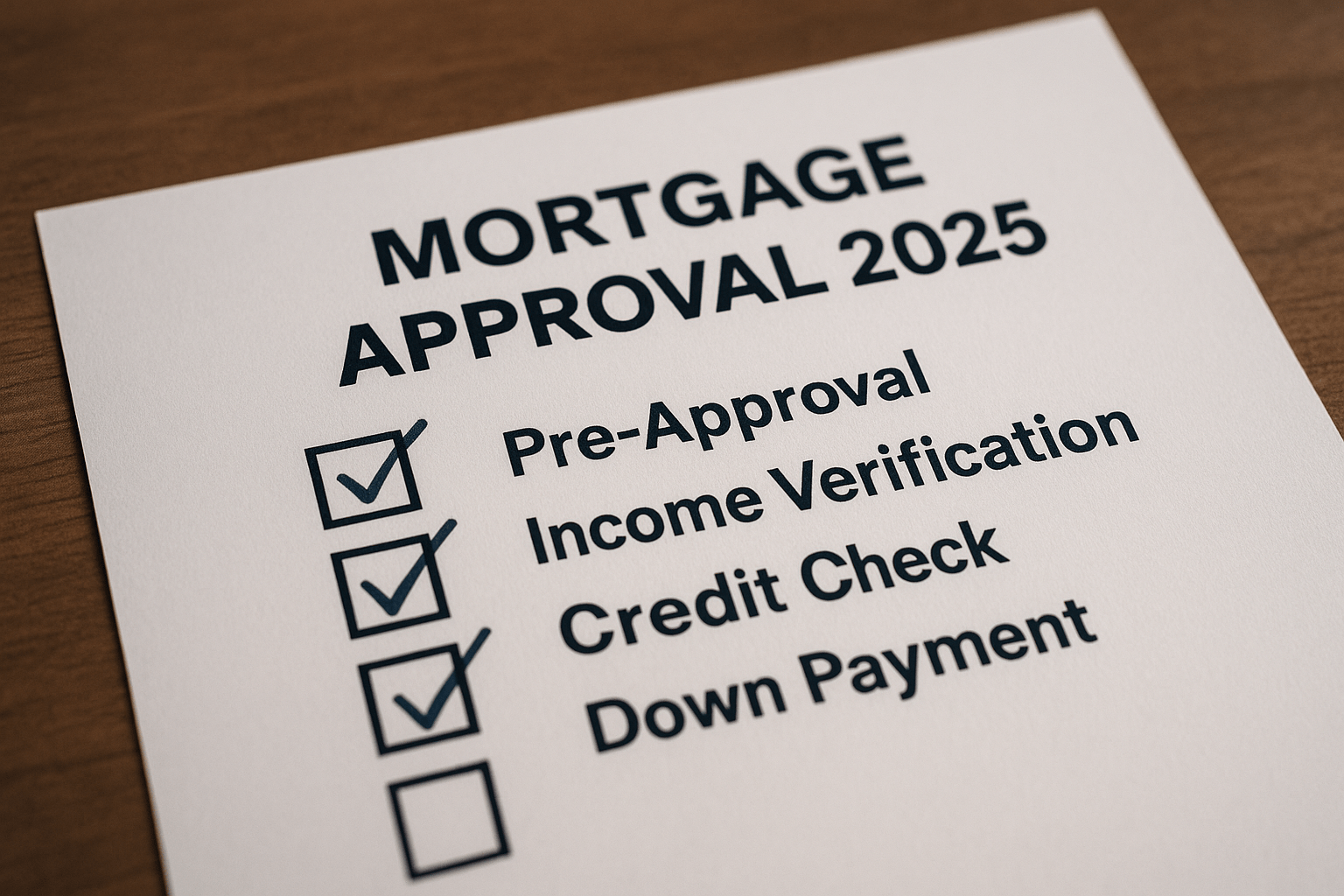

Your Mortgage Approval Checklist

To ensure you are prepared, here’s a comprehensive mortgage approval checklist.

1. Personal Identification

You’ll need to provide proof of identity. This may include:

- Government-issued ID – Passport or driver’s license.

- Social Insurance Number – Essential for credit checks.

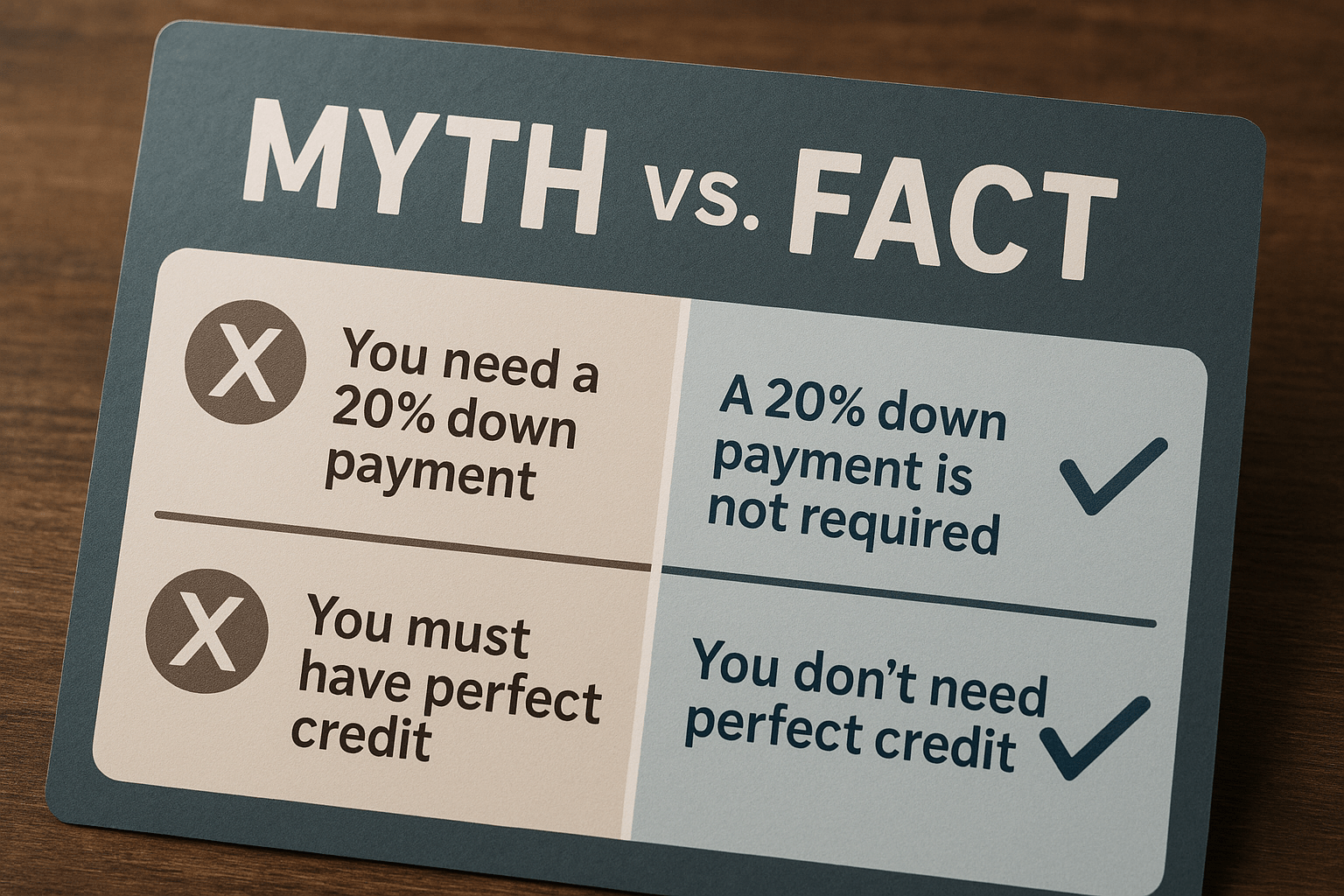

2. Credit Information

Check your credit report before applying. Aim for a score of 680 or higher. Gather the following details:

- Credit report – Obtain from major credit bureaus.

- Credit history – List all debts, including credit cards, loans, and mortgages.

3. Employment and Income Verification

Lenders will verify your income sources. Collect these documents:

- Recent pay stubs – Typically the last two to three months.

- Tax returns – Usually the last two years.

- Employment letter – Confirming your job and salary.

4. Financial Assets and Liabilities

Lenders want a complete picture of your finances. This includes:

- Bank statements – Last three to six months for checking and savings accounts.

- Investment accounts – Provide details on stocks, bonds, or mutual funds.

- Retirement accounts – If applicable, include RRSP or other retirement funds.

5. Property Information

If you have a specific property in mind, gather details:

- Purchase agreement – Once you’ve made an offer.

- Property listing – Information about the home you wish to buy.

- Home inspection report – Optional but helpful for negotiations.

6. Additional Documentation

Depending on your situation, you may need to include:

- Divorce decree – If applicable, showing financial obligations.

- Gift letters – If family members are aiding with the down payment.

- Residency status documentation – Particularly for non-citizens.

Final Steps Before Submission

Check your documents thoroughly. Make sure everything is up to date and accurate. A well-prepared application can expedite the approval process.

Moving Forward

Once you’ve completed your checklist, submit your application. Stay in touch with your lender to resolve any queries quickly.

With these tools and techniques, you can approach the mortgage process with confidence.

Looking to buy or sell this season? Contact Bridge today.