Related Articles

Seamless Real Estate Services with Bridge

When it comes to buying, selling, or upgrading your home, having access to exceptional real estate services is key to... Read more

Do Energy Efficient Homes Sell for More? Here’s the Data for Ontario, Canada

The real estate market in Ontario is evolving, with increasing attention on energy efficient homes. Homebuyers are becoming more environmentally conscious,... Read more

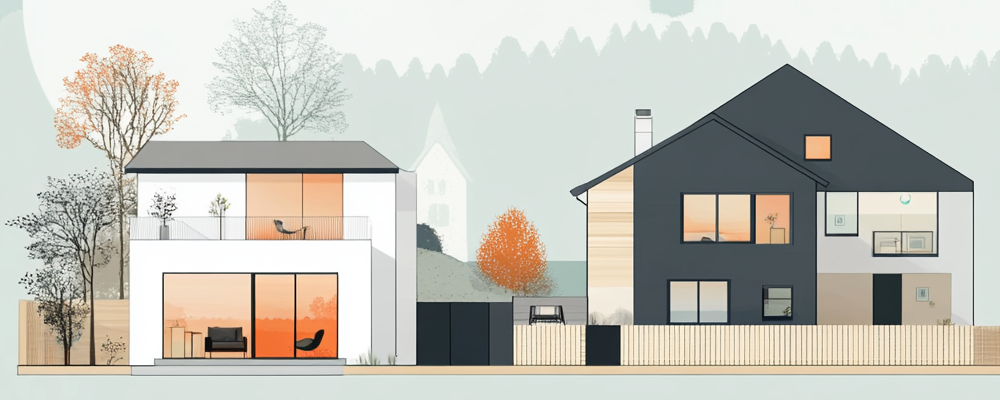

Sustainable Home: The Future of Living

Energy and Water Efficiency Sustainable homes are designed to conserve energy and water. High-efficiency equipment, better insulation, and energy-saving features lower... Read more